Money Loan - Instant Loan, Personal Loan App

Description of Money Loan - Instant Loan, Personal Loan App

Platform for users who apply cash loan with low interest rates here. We are regulaery optimize functions to provide users with better performance, faster and more reliable instant loan services.

We are providing EMI Calculator feature so it helps to the user to quickly calculate EMI of Home loan EMI, Personal loan EMI, Car loan EMI, Bike loan EMI and view payment schedule. Calculate the EMI of one bank and compare it with other banks. You can also easy to compare two loans by using Loan EMI Calculator. Save yourself from complicated banking calculations.

Our Instant Personal Loan App helps you to check bank balance anytime, anywhere.This app is completely free bank balance checking an app for users who want check bank balance.

in India has always been a topic of discussion because of strict banking regulations and less financial inclusion. Huge population has been deprived of

to fulfill their need.

Money Loan provides

and

digitally with the help of only two documents like PAN Card and Aadhaar card. With Money Loan a

you get easy cash loans. Money Loan

comes with the idea of issuing personal loans online to all types of customer and can get your loan app approved instantly.

It only takes five minutes to complete your instant cash loan app and once your loan application is approved, the amount of your instant loan is disbursed in your bank account. You don’t have to ask cash loan from their family or friends or shopkeepers and feel humiliated at times. We want all our users to get easy cash loan, with easy repayment options, instant loan approvals,

and 24*7 customer support for any query on your cash loan account.

1. 100% online loan application process.

2. Instant Personal Loan Online.

3. Affordable and low-interest rates.

4. High loan approval rate.

5. Loan application is secure and confidential.

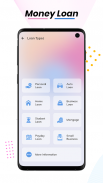

6. EMI calculators - Personal loan, Home loan, Business loan, and Fixed Deposit

7. It saves your time and efforts of visiting banks physically- Various loan options are available to choose from such as Home loan, Personal loan, Business loan, and Car loan

- A bank account.

- Above 18 years old.

- Valid Document

- Should have monthly source of income

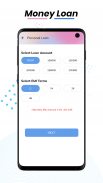

- Loan amount from ₹1000 to ₹2,00,000

- Repayment periods from 3 Month to 24 Month

- APR from 12% to 28% per annum in india.

- Processing fees range from 2.5% to 5% (GST 18% applies)

- You may be charged up to 0.1 % daily late fees for late payments ( capped to 18% of principal amount overdue ).

- No other hidden fees applicable to your loans!

- Minimum period for repayment = 3 months (90 days)

- Maximum period for repayment = 60 months

- Credit ₹5,000 at an APR of 12% (per annum) with a tenure of 61 days

- Interest of loan = ₹5,000 x 12 %/ 365 x 60 = ₹98

- Processing fee of loan = ₹5,000 x 3% = ₹150 (Also on which GST apply of ₹27)

- Total cost of the loan = ₹248

- Total loan amount disbursed will be credit is ₹4,848 (₹5,000 - ₹152)

- Total loan amount to repay will be ₹5098 (₹5000 + ₹98)

- Monthly repayments of ₹2549

The lenders we connect you with do not offer short-term loans. We are not lenders, don’t make credit decisions or loan decisions, do not endorse lenders.

Contact us by email: